You are here

Paying Attention to Teacher Pensions

CALDER Explainers are designed to succinctly describe empirical research on contemporary topics in education and encourage evidence-based policymaking.

This CALDER Explainer reviews the issue of teacher pensions. We provide background information and cover research on rising pension costs, how the pension structure influences the teaching workforce, and teacher preferences over retirement benefits.

View this explainer as a PDF here.

Background

Unlike their private-sector professional counterparts, public school teachers receive a significant fraction of their compensation in the form of a defined-benefit pension. On average across states, teachers and their employers today contribute over 20 percent of earnings to pay for pension benefits (this cost does not include other benefits, like healthcare).

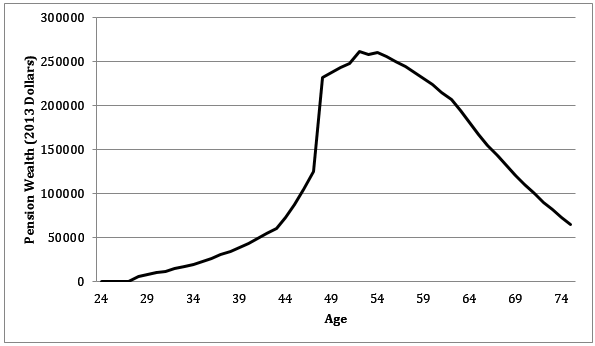

Wealth accrual in the pension plans in which most teachers are enrolled is heavily backloaded. This means that early in the career, teachers accrue little pension wealth, but late in the career wealth accrues rapidly. The wealth accrual profile for a typical entering teacher at age-24 in Missouri is provided in Figure 1 for illustration. Teachers who remain in the profession (and in the same pension plan) for a full career receive a pension that replaces a large fraction of their peak career earnings, and can often retire and begin collecting benefits in their mid- to late-50s. However, teachers who leave prior to attaining collection eligibility receive much less remunerative benefits. The backloading of wealth accrual is such that pension systems implicitly transfer resources from short-term to full-career teachers.

Figure 1. Wealth Accrual Over the Course of the Career for a Representative Teacher in Missouri.

Source: Koedel, Cory and Michael Podgursky (forthcoming). Teacher Pensions in Handbook of Economics of Education vol. 4 (eds. Eric A. Hanushek, Steven Machin and Ludger Woessmann).

As with pension costs in other public sector occupations, pension costs for teachers are rising. Prominent economists have argued that overly optimistic actuarial assumptions all but ensure that costs will continue to rise because pension liabilities will outpace the accumulation of assets. Using recent data, CALDER Working Paper 148 researchers document that on average across state plans in the US, currently over 10 percent of working teachers’ salaries are used to pay down previously accrued pension liabilities.

Pension funding problems are just beginning to reach a level of severity that consequences in terms of the delivery of public education services are visible. Unsurprisingly, initial indicators of the pressure exerted by pension funding problems are most prominent in municipal-level plans. A notable example is Chicago Public Schools, which has been in the news recently for the difficult decisions its administrators are facing in efforts to meet pension obligations. But make no mistake – state plans are not in good financial standing either, and the fundamental problems that have led to the trouble in Chicago (and other municipal plans, like St. Louis are present in the larger state plans in which most teachers are enrolled.

Workforce Effects

We provide context for interpreting the precarious fiscal situation of teacher pension plans by reviewing the research evidence on their educational benefits. We explore how teachers’ decisions to remain in or exit from the profession are influenced by their pension incentives, the implications of pension boundaries for teacher mobility, the relationship between pensions and teacher quality, and teacher preferences for different plan designs.

An initial question is whether teachers respond to their DB pension incentives at all. Early in the career, the backloaded accrual structure exerts a “pull” incentive, encouraging teachers to remain in the workforce. Later in the career – and in particular after teachers attain retirement eligibility – pension plans exert a “push” incentive, encouraging teacher to retire. CALDER Working Paper 147 illustrates that retirements are responsive to system incentives. Robert Costrell and Michael Podgursky, Maria Fitzpatrick and Michael Lovenheim, and Douglas Harris and Scott Adams have all published similar findings. A notable implication is that because pension incentives change sharply from exerting “pull” to “push” incentives, and for many teachers this sharp change occurs during their 50s, on average teachers retire at young ages compared to private-sector professionals. Policy simulations by Ni and Podgursky]in CALDER Working Paper 147 indicate that moving to a retirement benefit structure with constant benefit accrual would lead to longer teaching careers.

While there is clear evidence that many teachers respond to their pension incentives, some nuance to this result is in order. Not all teachers respond (for example, some teachers work far past the point at which they become eligible for full benefit collection, foregoing years of pension payments in the process), and CALDER Working Paper 123 finds no evidence that teachers in St. Louis were responsive to a large and expensive improvement to their benefit formula. Notably, the formula improvement in St. Louis did not change key incentive benchmarks in the pension plan, but rather the financial returns to meeting the benchmarks. An explanation for the St. Louis result is that teachers were already responding to the pension structure prior to the benefit enhancement, and the incentive change that it induced, although expensive to implement, was such that the marginal response by teachers was necessarily limited. The findings in CALDER WP 123 are consistent with findings from Chan and Stevens, who show that while most pensioners understand the basic rules of their pension plans, they are much less knowledgeable about the more complex aspects of their plans, like the value of remaining in covered employment until full retirement eligibility.

CALDER Working Papers 143 and 67 explore teacher and principal mobility near pension boundaries and highlight the substantial penalties to cross-plan movement imbedded in teacher pension plans. It is important to recognize that the “pull” incentives discussed above do not apply to the teaching profession, but rather to individual pension plans. A teacher who changes plans incurs the same financial penalty as a teacher who exits the profession entirely. The high mobility costs are notable given that worker mobility in general is on the rise in the United States. As noted in the CALDER explainer on teacher shortages, the non-portability of teachers’ pension benefits may inhibit teacher mobility in ways that make it difficult for schools to fill shortages and compete for teachers.

Several studies have examined the link between teachers’ pension incentives and teacher quality. CALDER Working Paper 72 looks for evidence of differences in quality between teachers working in the “pull” and “push” regions of the incentive structure and finds no differences conditional on experience; if anything, the results suggest that teachers held in by the pull incentives are less effective than other teachers. Related, indirect evidence on this point comes from a 2014 study by Maria Fitzpatrick and Michael Lovenheim, who show that after a policy that temporarily reduced the early-exit penalty in the Illinois pension plan – and correspondingly increased exits among teachers who were being held in by the pull incentive – student achievement stayed the same or even improved, despite the fact that the policy resulted in a reduction in teaching experience in the workforce. Overall, there is no evidence to suggest that these peculiar, and expensive, pension incentives improve workforce quality, and if anything the evidence is to the contrary.

What about teacher preferences? Do teachers prefer DB benefits to alternative forms of compensation – e.g., defined-contribution (DC) pensions or simply higher salaries? CALDER Working Paper 111 studies a fairly unique “pension choice” environment in the state of Washington, where teachers can choose between a traditional DB pension plan and a hybrid plan. In the hybrid plan, retirement contributions accrue in the form of both DB and defined contribution (DC) benefits. The authors find that teachers are divided in their preferences, but the majority prefer the hybrid plan, and more effective teachers are more likely to enroll in the hybrid plan (Chingos and West provide related evidence from the state of Florida). In another recent article, Maria Fitzpatrick leverages a short term policy in Illinois that allowed teachers to purchase additional DB pension benefits with current income to examine how teachers value future pension dollars against current dollars. Fitzpatrick finds that teachers tend to have a low willingness to pay for a marginal dollar of future pension payments, a result she suggests could be attributable to their being “oversaturated with this particular annuitized illiquid asset.” One implication of the low value that teachers place on future DB benefits is that the funding of these benefits is unlikely to be the type of investment in compensation that will be most effective in making teaching a desirable profession.

Conclusions

The fiscal condition of DB pension plans that cover public educators is worsening, and a more visible role of pension financing issues in policy discussions surrounding the delivery of public education services in the United States can be expected moving forward. In recent years a number of states have begun to reform their pension plans. Structural reforms have occurred in some states, like Kansas and Tennessee, which have moved teachers into “cash balance” and hybrid pension plans, respectively. Other reforms have maintained the traditional DB pension structure, but simply lower benefits for new workers (as has occurred in many states including Alabama, Illinois, and New Jersey). Research provides some insights into how these reforms are likely to influence the teaching workforce, but the research base in this area is thin, and we would benefit from more evidence. Moreover, as pension plan changes become more common, and more substantial, continued research aimed at understanding teacher responses is crucial. Evidence on young teachers, and individuals who have yet to enter the workforce but are considering a teaching career, would be particularly valuable as we currently know very little about how pensions influence selection into the profession. Teacher and school-system responses to the changing resource demands of teachers’ pension plans also merits study.

--

All of CALDER’s Working Papers and further information about teacher pensions can be found at CALDER’s website, www.caldercenter.org

This research is supported by the Laura and John Arnold Foundation and the National Center for Analysis of Longitudinal Data in Education Research (CALDER) funded through grant #R305C120008 to American Institutes for Research from the Institute of Education Sciences, U.S. Department of Education. The views expressed here are those of the authors and should not necessarily be attributed to their institutions, data providers, or the funders. Any and all errors are attributable to the authors.

Suggested Citation: Koedel, Cory and Michael Podgursky. (2015). Paying Attention to Teacher Pensions. Washington, DC: National Center for the Analysis of Longitudinal Data in Education Research (CALDER), American Institutes for Research.

Revised versions of CALDER working papers and other papers cited here have been published in peer-reviewed journals:

Backes, B., Goldhaber, D., Grout, C., Koedel, C., Ni, S., Podgursky, M., Xiang, P.B., and Xu, Z. (2015). Benefit or burden? On the intergenerational inequity of teacher pension plans. Working Paper 148. National Center for Analysis of Longitudinal Data in Education Research.

Chan, S., & Stevens, A. H. (2008) What you don't know can't help you: Pension knowledge and retirement decision-making. The Review of Economics and Statistics 90(2), 253-266.

Chingos, M. W. & West, M.R. (2015) Which Teachers Choose a Defined Contribution Pension Plan? Evidence from the Florida Retirement System. Education Finance and Policy 10(2), 193-222.

Costrell, R. (2015). School Pension Costs Have Doubled over the Last Decade, Now Top $1,000 Per Pupil Nationally. TeacherPensions.org. Retrieved from http://www.teacherpensions.org/blog/school-pension-costs-have-doubled-over-last-decade-now-top-1000-pupil-nationally

Costrell, R. M. & Podgursky, M. (2009) Peaks, Cliffs and Valleys: The Peculiar Incentives in Teacher Retirement Systems and Their Consequences for School Staffing. Education Finance and Policy 4(2), 175-211.

Fitzpatrick, M. (2015) How Much Do Public School Teachers Value Their Pension Benefits? American Economic Journal: Economic Policy 7(4), 165-188.

Fitzpatrick, M. & Lovenheim, M. (2014) Early Retirement Incentives and Student Achievement. American Economic Journal: Economic Policy 6(3), 120-154.

Goldhaber, D., & Grout, C. (2014) Which Plan to Choose? The Determinants of Pension System Choice for Public School Teachers. Working Paper 111. National Center for Analysis of Longitudinal Data in Education Research. (Goldhaber, D., & Grout, C. (2013). Which plan to choose? The determinants of pension system choice for public school teachers. Journal of Pension Economics and Finance, 1-25.)

Goldhaber, D. Grout, C., Holden, K. & Brown, N. (2015). Crossing the Border? Exploring the Cross-State Mobility of the Teacher Workforce. Working Paper 143. National Center for Analysis of Longitudinal Data in Education Research.

Harris, D. N. & Adams, S. J. (2007) Understanding the Level and Causes of Teacher Turnover: A Comparison with Other Professions. Economics of Education Review 26(4), 325-337.

Kambourov, G. & Manovskii, I. (2008) Rising Occupational and Industry Mobility in the United States: 1968-97. International Economic Review 49(1), 41-79.

Koedel, C., Grissom, J. A., Ni, S., & Podgursky, M. (2012). Pension-Induced Rigidities in the Labor Market for School Leaders. Working Paper 67. National Center for Analysis of Longitudinal Data in Education Research.

Koedel, C. & Podgursky, M. (forthcoming) Teacher Pensions in Handbook of Economics of Education vol. 4 (eds. Eric A. Hanushek, Steven Machin and Ludger Woessmann).

Koedel, C., & Podgursky, M. (2012). Teacher Pension Systems, the Composition of the Teaching Workforce, and Teacher Quality. Working Paper 72. National Center for Analysis of Longitudinal Data in Education Research. (Koedel, C., Podgursky, M., & Shi, S. (2013) Teacher Pension Systems, the Composition of the Teaching Workforce, and Teacher Quality. Journal of Policy Analysis and Management 32(3), 574-596.)

Koedel, C., & Xiang, P. B. (2015) Pension Enhancements and the Retention of Public Employees: Evidence from Teaching. Working Paper 123. National Center for Analysis of Longitudinal Data in Education Research.

Korecki, N., Spielman, F., & fitzpatrick, L. (2015). CPS makes pension payment — with 1,400 layoffs, borrowing. Chicago Sun Times. Retrieved from http://chicago.suntimes.com/news/7/71/734086/cps-pension-payment-1400-layoffs-borrowing%5d.

Ni, S., & Podgursky, M. (2015) How Teachers Respond to Pension System Incentives: New Estimates and Policy Applications. Working Paper 147. National Center for Analysis of Longitudinal Data in Education Research. (Ni, S. & Podgursky, M. (forthcoming) How Teachers Respond to Pension System Incentives: New Estimates and Policy Applications. Journal of Labor Economics.)

Novy-Marx, R. & Rauh, J. (2009) The Liabilities and Risks of State-Sponsored Pension Plans. Journal of Economic Perspectives 23(4), 191-210.

Podgursky, M., & Ehlert, M. (2007) Teacher Pensions and Retirement Behavior: How Teacher Pension Rules Affect Behavior, Mobility, and Retirement. Working Paper 5. National Center for Analysis of Longitudinal Data in Education Research.

Sawchuck, S. (2013). Teacher-Pension Costs Could Put Squeeze on More Districts. Education Week. Retrieved from http://www.edweek.org/ew/articles/2013/06/05/33pensions_ep.h32.html